New Product Launch –EQUITY TRADING ADVISORY SERVICES

WHY INDIAN RUPEE FALLING PRECIPITOUSLY…..

Register your Mobile number to receive free Trading Advisory services till 30th Sep.

Calls of last 2 days – Investors earned 4.5% in Rpower, 8 %in Gold, 20 % in Silver

To register SMS your Name and Mob No on 98255 28815

Dear Investor

I have been writing since last 3 months consistently pressing on my view that Dollar will go up and rest everything( i.e. everything be it Equity, Commodity, Precious metal or other currencies) will collapse miserably.

Today, we are witnessing the same since last 1.5 months, every asset class is crashing against dollar.

Refer articles

A Crash in Progress – https://investmentacademy.wordpress.com/2011/02/04/a-crash-in-progress/

Quick Update on A Crash in Progress – https://investmentacademy.wordpress.com/2011/02/12/a-quick-update-on-a-crash-in-progress-2/

Gold, Silver to correct 20-30%, Real Estate 40%, Commodities and Metals to follow – https://investmentacademy.wordpress.com/2011/03/15/gold-silver-to-correct-20-30-real-estate-40-commodities-and-metals-to-follow/

And few more articles, where I gave my detailed views on reasons of market correction and with precise targets.

In very short period of 2 months, Indian rupee fell sharply from Rs. 44/$ to Rs. 49.93 / $. It has created havoc amongst Exporters, Importers, Traders and Investors.

There are various reasons for that let us go through one by one

Let me take Technical parameters first..

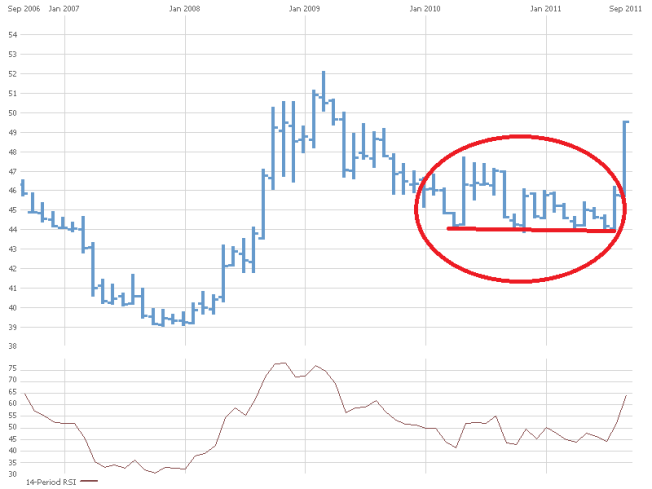

Rupee has been forming base since April, 2010 around 44 level. And, below chart would clear much of your doubts that Why it went up ballistic Rs. 6 from 44 level to the level of 50. This is single most important reason for rupee’s sudden fall in value.

RBI vs Chinese Central Bank

To cool inflation, RBI raised interest rates but did not manage the rupee well. ( Your analyst was among the first to predict interest rate rise ). India is net importer. We import 30% more than what we export.

It has been evident since long that Commodity prices are up and going up more, it was RBI’s duty to keep check on rupee to ensure sustained exports and moderate inflation.

China has kept its currency tight under control and that has helped China to weather inflationary wave smoonthly.

Fiscal Disaster

For most part of this, Indian Govt is responsible. I had been warning since last 2 years thatWe need to keep our house in order. You can refer my article (https://investmentacademy.wordpress.com/2010/01/28/fiscal-disaster/ ) . It is seer insane mismanagement of finances which has brought us to this stage. Since 2008, Govt has been borrowing close to 4 to 4.5 lac crore from market for different budget schemes, it is close to 50-60% of Govt’s annual revenue.

It kills economy 2 ways, it keeps economy up artificially where real demand is replaced by Govt’s artificial temporary demand and It negates the effect of rise in interest rate.

I shall update this issue in detail next month.

What I Expect in Near term?

I feel Rupee should retrace some of its rise from recent high of 49.93. Should consolidate around 47.5-48 in short term and should head up again to conquer previous highs of 51.17.

Reasons are very apparent. Some rebound in stock markets and commodities from recent sell off will give respite to rupee for some time and then renewed Global sell off should push down all markets(Equity, Commodity , Bullion) and rupee ,too, will fall again sharply to lower levels of 52 and might be 54.

Regards

Dhaval Shah

Blog: https://investmentacademy.wordpress.com/

Mob: 98255 28815